Integrate payments with ease

Enable payments from your platform with full customization, or by leveraging our pre-built hosted solutions.Receive end-to-end implementation support

Enjoy a smooth experience from integration to launch with our white-glove approach.Build without the overhead

We manage risk, PCI compliance and merchant payouts so you don’t have to.

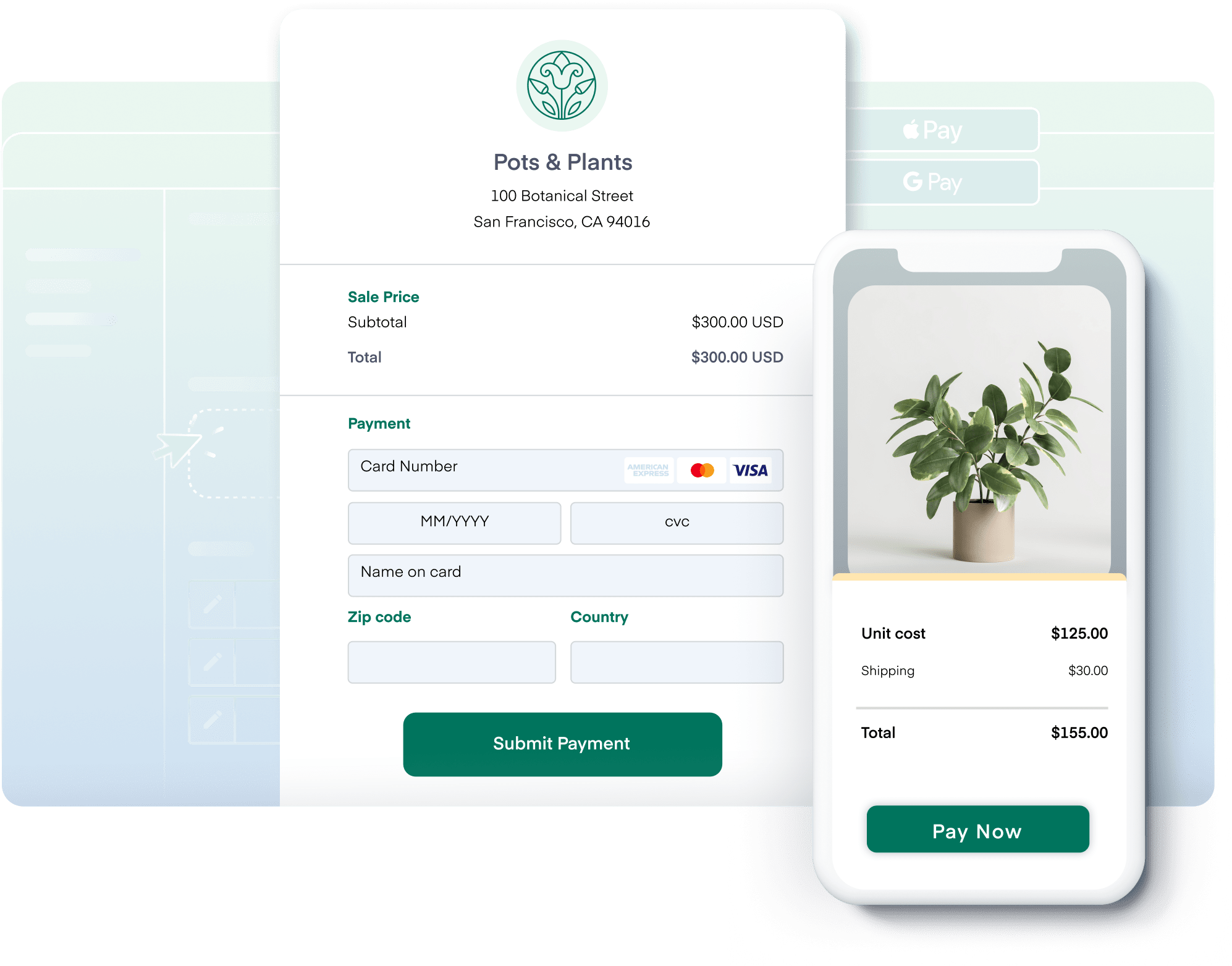

Deliver a seamless experience on your platform

Seamlessly integrate payments into your application; we’ll support you from behind-the-scenes.

Integrate onboarding requirements into your existing sign-up flow.

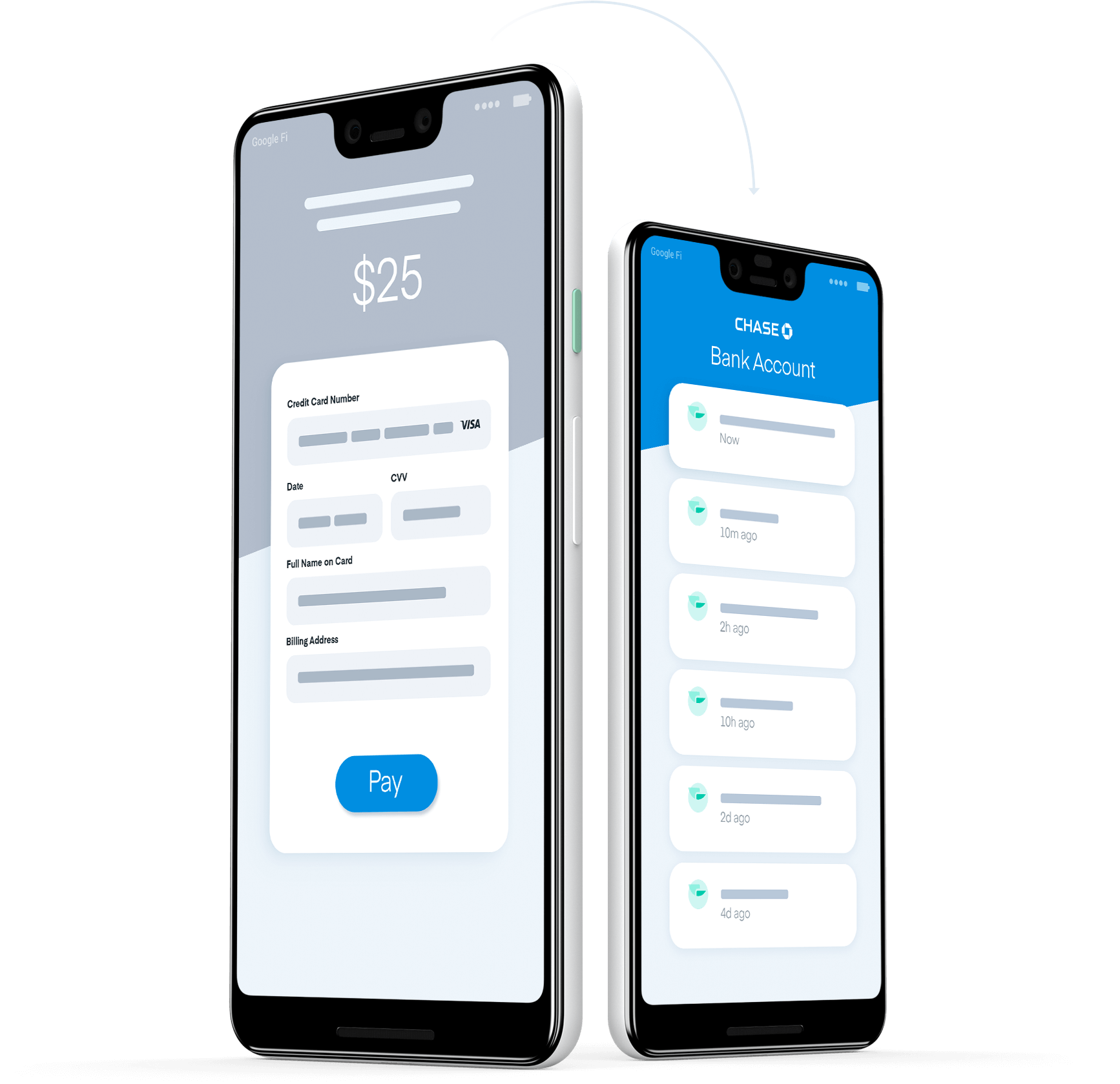

Same-Day Deposits are available to eligible merchants of software platforms with a 5 PM PT cut-off time for payments processed on WePay. Merchants must deposit into a single Chase bank account. Payments approved by 5 PM PT are eligible. All transactions are subject to WePay terms of service and exclusions therein, including risk assessment and fraud monitoring, which may result in delays. Funds are deposited on business days, excluding weekends and bank holidays. Available in the U.S. only. Contact api@wepay.com for more information.

Merchants with a Chase bank account can receive same-day deposits, at no additional cost.

Integrate payment data into your existing user experience.

Fully functional feature set

Onboarding

- Progressive onboarding

- White-label experience

- Referrals from Chase

- UK & Canada support

- Support for merchant communication

Payments

- Credit, Debit, e-check

- Digital Wallets

- Card Present Solutions

- Account updater

- Multiple Payment Capture Methods

- Easy PCI-DSS Compliance

- Card Vault / Tokenization

Payouts

- Payment to Payout Reconciliation

- Same-day deposits with no extra fees

- Flexible Payout Schedules

Portfolio Management

- Partner Center (reporting and analytics

- Merchant Center (digital servicing)

- Earnings & Performance Reporting

- Terminal Management

- Account History

Risk & Compliance

- Custom Risk Management

- Fraud and chargeback loss protection

- AML / KYC Checks

- 1099-K Management

.svg)